| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#)(1) Unexercisable | | | Option Exercise Price ($) | | | Option Expiration Date | | | | | | | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(5) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Option Awards | | | | | | Stock Awards | | Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#)(1) Unexercisable | | Option Exercise Price ($) | | Option Expiration Date | | | | | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($)(5) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(5) | | | | | | | | | | | | Sean D. Keohane | | | | 14,297 | | | | | — | | | | | 47.62 | | | | | 11/7/2023 | | | | | | | | | | | | | | | 27,000 | | | | | 1,353,240 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 17,857 | | | | | — | | | | | 46.03 | | | | | 11/13/2024 | | | | | | | | | | | | | | | 26,876 | | | | | 1,347,025 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 25,617 | | | | | — | | | | | 39.54 | | | | | 11/11/2025 | | | | | | | | | | | | | | | 34,781 | | | | | 1,743,224 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 26,455 | | | | | — | | | | | 49.26 | | | | | 3/20/2026 | | | | | | | | | | | | | | | 20,937 | (2) | | | | 1,049,362 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 87,981 | | | | | — | | | | | 50.46 | | | | | 11/10/2026 | | | | | | | | | | | | | | | 17,664 | (3) | | | | 885,320 | | | | | 20,904 | (6) | | | | 1,047,708 | | | | | | | | | | | | | | | | | 91,923 | | | | | — | | | | | 62.24 | | | | | 11/9/2027 | | | | | | | | | | | | | | | 27,052 | (4) | | | | 1,355,846 | | | | | 54,104 | (7) | | | | 2,711,692 | | | | | | | | | | | | | | | | | 82,604 | | | | | 55,070 | | | | | 50.00 | | | | | 11/8/2028 | | | | | | | | | | | | | | | | | | | 19,024 | | | | 862,168 | | | | — | | | | — | | | | | 17,857 | | | | — | | | | 46.03 | | | | 11/13/2024 | | | | | | | | | | | | 19,280 | | | | | | | | | | | 873,770 | | | | — | | | | — | | | | | 25,617 | 44,241 | | | | | —103,230 | | | | | 39.5450.23 | | | | | 11/11/20257/2029 | | | | | | | | | | | | | | | | | | | 27,000 | | | | 1,223,640 | | | | — | | | | — | | | | | 26,455 | | | | — | | | | 49.26 | | | | 3/20/2026 | | | | | | | | | | | | 33,980 | | | | | | | | | | | | | | | | | | — | | | | | 171,568 | | | | | 40.97 | | | | | 11/12/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Erica McLaughlin | | | | 2,295 | | | | | — | | | | | 46.03 | | | | | 11/13/2024 | | | | | | | | | | | | | | | 4,650 | | | | | 233,058 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 3,293 | | | | | — | | | | | 39.54 | | | | | 11/11/2025 | | | | | | | | | | | | | | | 4,927 | | | | | 246,941 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 3,534 | | | | | — | | | | | 50.46 | | | | | 11/10/2026 | | | | | | | | | | | | | | | 7,322 | | | | | 366,979 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 3,151 | | | | | — | | | | | 62.24 | | | | | 11/9/2027 | | | | | | | | | | | | | | | 3,606 | (2) | | | 1,539,974 | 180,733 | | | | | — | | | | | — | | | | | | | | | | | | | | | | 52,788 | 8,910 | | | | | 35,193— | | | | | 50.4661.17 | | | | | 5/14/2028 | | | | | | | | | | | | | | | 3,238 | (3) | | | | 162,289 | | | | | 3,832 | (6) | | | | 192,060 | | | | | | | | | | | | | | | | | 14,226 | | | | | 9,484 | | | | | 50.00 | | | | | 11/10/20268/2028 | | | | | | | | | | | | | | | 5,694 | (4) | | | | 285,383 | | | | | 11,390 | (7) | | | | 570,867 | | | | | | | | | | | | | | | | | 8,110 | | | | | 18,926 | | | | | 50.23 | | | | | 11/7/2029 | | | | | | | | | | | | | | | | | | | 22,882 | (3) | | | 1,037,012 | | | | 11,247 | (6) | | | 509,714 | | | | | 27,576 | | | | 64,347 | | | | 62.24 | | | | 11/9/2027 | | | | | | | | | | | | 7,980 | (4) | | | | | | | | | 361,654 | | | | 21,000 | (7) | | | 951,720 | | | | | | — | | | | 137,674 | | | | 50.00 | | | | 11/8/2028 | | | | | | | | | | | | | | | | | | | | | | | | | | Erica McLaughlin | | | 2,295 | | | | — | | | | 46.03 | 36,119 | | | | | 40.97 | | | | | 11/13/202412/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Karen A. Kalita | | | | — | | | | | 4,575 | | | | | 40.91 | | | | | 6/2/2029 | | | | | | | | | | | | | | | 900 | | | | | 45,108 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | — | | | | | 13,764 | | | | | 50.23 | | | | | 11/7/2029 | | | | | | | | | | | | | | | 1,833 | | | | | 91,870 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | — | | | | | 22,574 | | | | | 40.97 | | | | | 11/12/2030 | | | | | | | | | | | | | | | 3,583 | | | | | 179,580 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | 1,783 | | | | 80,806 | | | | — | | | | — | | | | | 3,293 | | | | — | | | | 39.54 | | | | 11/11/2025 | | | | | | | | | | | | 1,542 | | | | | 69,883 | | | | | | 4,576 | | | | | 229,349 | | | | | — | | | | | — | | | | | | | | | | | | | | | | 2,120 | | | | 1,414 | | | | 50.46 | | | | 11/10/2026 | | | | | | | | | | | | 1,839 | | | | 83,343 | | | | — | | | | — | | | | | 945 | | | | 2,206 | | | | 62.24 | | | | 11/9/2027 | | | | | | | | | | | | 4,650 | | | | | 210,738 | | | | | | 399 | (2) | | | | 19,998 | | | | | — | | | | | — | | | | | | | | | | | | | | | | 2,673 | | | | 6,237 | | | | 61.17 | | | | 5/14/2028 | | | | | | | | | | | | 1,820 | (2) | | | 82,482 | | | | — | | | | — | | | | | — | | | | 23,710 | | | | 50.00 | | | | 11/8/2028 | | | | | | | | | | | | 1,045 | | | | | | | | | | | 1,421 | (3)(2) | | | 47,359 | 71,221 | | | | | 515— | (6) | | | 23,340 | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,182 | (3) | | | 98,888 | | | | 1,073 | (6) | | | 48,628 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,374 | (4) | | | 62,270 | | | | 3,617 | (7) | | | 163,922 | | Karen A. Kalita

| | | — | | | | 11,437 | | | | 40.91 | | | | 6/2/2029 | | | | | | | | | | | | 772 | | | | 34,987 | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 723 | 2,354 | (3) | | | | 32,766117,982 | | | | | —2,788 | (6) | | | | —139,735 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,558 | (4) | | | | 178,327 | | | | | 7,120 | (7) | | | | 356,854 | | | | | | | | | | | | | Hobart C. Kalkstein | | | | 18,558 | | | | | — | | | | | 50.46 | | | | | 11/10/2026 | | | | | | | | | | | | | | 900 | 4,800 | | | | | 40,788240,576 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 17,235 | | | | | — | | | | | 62.24 | | | | | 11/9/2027 | | | | | | | | | | | | | | | | | 1,833 | 4,778 | | | | | 83,072239,473 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 14,684 | | | | | 9,791 | | | | | 50.00 | | | | | 11/8/2028 | | | | | | | | | | | | | | | | | 789 | (2)6,590 | | | | 35,757 | 330,291 | | | | | — | | | | | — | | | | | | | | | | | | | | | | | 7,865 | | | | | 18,352 | | | | | 50.23 | | | | | 11/7/2029 | | | | | | | | | | | | | | | | | 489 | 3,722 | (3)(2) | | | 22,161 | 186,547 | | | | | 242— | (6) | | | 10,967 | — | | | | | | | | | | | | | | | | | — | | | | | 32,507 | | | | | 40.97 | | | | | 11/12/2030 | | | | | | | | | | | | | | | | | 152 | 3,140 | (3) | | | | 157,377 | | | | | 3,716 | (6) | | | | 186,246 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 5,124 | (4) | | | 6,889 | 256,815 | | | | | 40010,252 | (7) | | | 18,128 | 513,830 | | | | | | | | | | | | | Jeff Zhu | | | | 13,763 | | | | | | | | | | | | | | | | | | | | | | | 541 | (4) | | | 24,518 | | | | 1,426 | (7) | | | 64,626 | | Hobart C. Kalkstein

| | | 4,017 | | | | — | | | | 46.03 | 35.25 | | | | | 11/13/20248/2022 | | | | | | | | | | | | | | 4,013 | 4,800 | | | | | 181,869240,576 | | | | | — | | | | — | | | | | 5,763 | | | | — | | | | | | | | | | | | | | | | | 22,415 | | | | | — | | | | | 39.54 | | | | | 11/11/2025 | | | | | | | | | | | | | | 3,615 | 4,778 | | | | | 163,832239,473 | | | | | — | | | | — | | | | | 4,251 | | | | — | | | | | | | | | 47.23 | | | | | | | | 4/6/14,434 | | | | | — | | | | | 50.46 | | | | | 11/10/2026 | | | | | | | | | | | | | | 4,800 | 6,590 | | | | | 217,536330,291 | | | | | — | | | | | — | | | | | | | | | | | | | | | | 11,134 | 18,384 | | | | | 7,424— | | | | | 50.4662.24 | | | | | 11/10/20269/2027 | | | | | | | | | | | | | | 7,166 | 3,722 | (2) | | | 324,763 | 186,547 | | | | | — | | | | | — | | | | | | | | | | | | | | | | 5,170 | 14,684 | | | | | 12,0659,791 | | | | | 62.2450.00 | | | | | 11/9/20278/2028 | | | | | | | | | | | | | | 4,289 | 3,140 | (3) | | | 194,377 | 157,377 | | | | | 2,1093,716 | (6) | | | 95,580 | 186,246 | | | | | | | | | — | | | | | | | | 24,4757,865 | | | | | 50.0018,352 | | | | | 50.23 | | | | | 11/8/20287/2029 | | | | | | | | | | | | 1,418 | (4) | | | 64,264 | | | | 3,734 | (7) | | | 169,225 | | Brian A. Berube

| | | 13,344 | | | | — | | | | 47.62 | | | | 10/14/2020 | | | | | | | | | | | | | — | 5,124 | (4) | | | | 256,815 | | | | | 10,252 | (7) | | | | 513,830 | | | | | | | | | | | | | | | | | — | | | | — | | | | —32,507 | | | | | 15,625 | | | | —40.97 | | | | 46.03 | | | | 10/14/2020 | | | | | | | | | | | | — | | | | — | | | | — | | | | — | | | | | 8,967 | | | | — | | | | 39.54 | | | | 10/14/2020 | | | | | | | | | | | | — | | | | — | | | | — | | | | — | | | | | 12,372 | | | | — | | | | 50.46 | | | | 10/14/2020 | | | | | | | | | | | | — | | | | — | | | | — | | | | — | | | | | 5,170 | | | | — | | | | 62.24 | | | | 10/14/2020 | | | | | | | | | | | | — | | | | — | | | | — | | | | — | | John R. Doubman

| | | 4,017 | | | | — | | | | 46.03 | | | | 11/13/2024 | | | 12/2030 | | | | | | | | | 2,972 | | | | 134,691 | | | | | — | | | | | — | | | | | 2,306 | | | | — | | | | | 39.54 | | | | 11/11/2025 | | | | | | | | | | | | 2,651 | (8) | | | 120,143 | | | | — | | | | — | | | | | 2,834 | | | | — | | | | 47.23 | | | | 4/6/2026 | | | | | | | | | | | | 3,600 | (8) | | | 163,152 | | | | — | | | | — | | | | | 8,248 | | | | 5,499 | | | | 50.46 | | | | 11/10/2026 | | | | | | | | | | | | 5,310 | (2) | | | 240,649 | | | | — | | | | — | | | | | 3,791 | | | | 8,848 | | | | 62.24 | | | | 11/9/2027 | | | | | | | | | | | | 3,145 | (3)(8) | | | 142,531 | | | | 1,547 | (6)(8) | | | 70,110 | | | | | — | | | | 18,356 | | | | 50.00 | | | | 11/8/2028 | | | | | | | | | | | | 1,064 | (4)(8) | | | 48,220 | | | | 2,800 | (7)(8) | | | 126,896 | |

56CABOT CORPORATION 49

Executive Compensation(continued) | 1. | Under our LTI Program, options generally vest over a three-year period as follows, generally subject to the named executive officer’s continued employment through the vesting date: 30% on each of the first and second anniversaries of the date of grant and 40% on the third anniversary of the date of grant. The stock options granted to Ms. Kalita on June 3, 2019 in connection with her promotion vest as follows, generally subject to her continued employment through the applicable vesting date: 30% on November 9, 2019, 30% on November 9, 2020 and 40% on November 9, 2021. Except for Mr. Berube, allAll options have a date of grant that is ten years prior to the “Option Expiration Date” listed in the table. The option expiration date for all of Mr. Berube’s outstanding vested options is October 14, 2020. In connection with Mr. Doubman’s termination of employment following the end of the fiscal year, the option expiration date for all of his vested options was extended to the earlier of (i) November 15, 2021, and (ii) the originally expiration date of the stock options and all of his then unvested options were forfeited. Further information regarding the treatment of Messrs. Berube’s and Doubman’s options on their respective terminations is included in the Compensation Discussion and Analysis section above. |

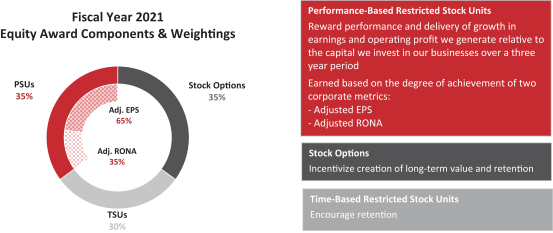

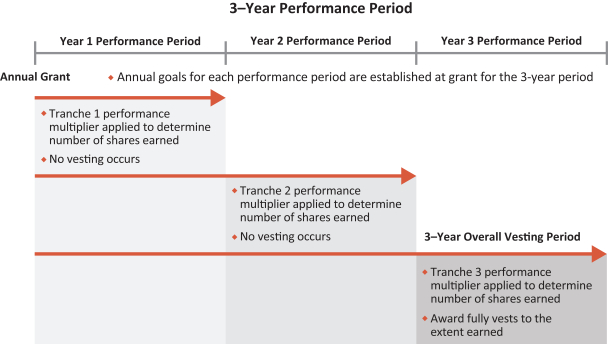

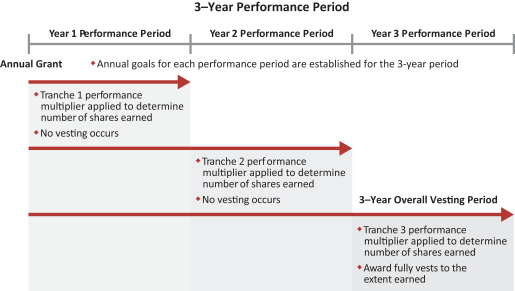

| 2. | Reflects the portion of the fiscal 20172019 PSUs earned based on the degree of achievement of the annual financial performance goals (adjusted EPS and adjusted RONA goals) for each of the three years within the three-year performance period of the award. These units vested on November 11, 2019,9, 2021, which was the third anniversary of the date of grant for all awards except for the supplemental award granted to Ms. Kalita in June 2019 in connection with her promotion, and were settled on November 20, 2019,22, 2021, the date the Compensation Committee determined the achievement of the adjusted EPS and adjusted RONA goals used to determine the number of PSUs earned during fiscal year 2019.2021. |

| 3. | Reflects the portion of the fiscal 20182020 PSUs earned based on the degree of achievement of the annual financial performance goals (adjusted EPS and adjusted RONA goals) for the first two years within the three-year performance period of the award. These units will vest on November 10, 2020,8, 2022, generally subject to the named executive officer’s continued employment through the vesting date. |

| 4. | Reflects the portion of the fiscal 20192021 PSUs earned based on the degree of achievement of the annual financial performance goals (adjusted EPS and adjusted RONA goals) for the first year within the three-year performance period of the award. These units will vest on November 9, 2021,13, 2023, generally subject to the named executive officer’s continued employment through the vesting date. |

| 5. | The value of unvested restricted stock units was calculated by multiplying the closing price of our common stock on September 30, 20192021 ($45.32)50.12) by the number of unvested restricted stock units. |

| 6. | Reflects the portion of the fiscal 20182020 PSUs that may be earned based on the degree of achievement of the annual financial performance goals (adjusted EPS and adjusted RONA goals) for the third year within the three-year performance period of the award. These units, to the extent earned, will vest on November 10, 2020,8, 2022, generally subject to the named executive officer’s continued employment through the vesting date. The number of shares shown for each named executive officer’s PSU award assumes the Company will achieve the stretchmaximum adjusted EPS goal and stretchmaximum adjusted RONA goal with respect to such award, based on fiscal 20192021 performance. |

| 7. | Reflects the portion of the fiscal 20192021 PSUs that may be earned based on the degree of achievement of the annual financial performance goals (adjusted EPS and adjusted RONA goals) for the second and third year within the three-year performance period of the award. These units, to the extent earned, will vest on November 9, 2021,13, 2023, generally subject to the named executive officer’s continued employment through the vesting date. The number of shares shown for each named executive officer’s PSU award assumes the Company will achieve the targetmaximum adjusted EPS goal and targetmaximum adjusted RONA metrics goal with respect to such award, based on fiscal 20192021 performance. |

8. | Mr. Doubman forfeited these TSUs and PSUs upon the termination of his employment on November 15, 2019.

|

Option Exercises and Stock Vested Table The following table shows the options exercised by our named executive officers and the TSUs and PSUs that vested for each named executive officer during fiscal 2019. There were no option exercises2021. The value of options realized on exercise is the difference between the closing price of our common stock on the exercise date and the exercise price, multiplied by our named executive officers during fiscal 2019.the number of shares acquired on exercise. The value of stock realized on the vesting of TSUs is the product of the number of shares vested and the closing price of our common stock on the vesting date. The value of stock realized on the vesting of PSUs is the product of the number of shares vested and the closing price of our common stock on the settlement date. | | | | | | | | | | | | Stock Awards | | | Name | | Number of Shares Acquired On Vesting (#) | | | Value Realized on Vesting ($) | | Sean D. Keohane | | | 32,019 | | | | 1,542,384 | | Erica McLaughlin | | | 3,641 | | | | 175,451 | | Karen A. Kalita | | | 1,820 | | | | 87,701 | | Hobart C. Kalkstein | | | 8,880 | | | | 427,863 | | Brian A. Berube | | | 23,986 | | | | 1,122,618 | | John R. Doubman | | | 8,045 | | | | 387,641 | |

50 CABOT CORPORATION

Executive Compensation(continued)

| | | | | | | | | | | | | | | | | | | | | | | | Option Awards | | Stock Awards | | Name | | Number of Shares

Acquired On Exercise (#) | | Value Realized on

Exercise ($) | | Number of Shares

Acquired On Vesting (#) | | Value Realized on Vesting ($) | | | | | | Sean D. Keohane | | | | — | | | | | — | | | | | 42,162 | | | | | 1,820,555 | | | | | | | Erica McLaughlin | | | | — | | | | | — | | | | | 6,608 | | | | | 285,333 | | | | | | | Karen A. Kalita | | | | 12,760 | | | | | 226,597 | | | | | 1,212 | | | | | 52,334 | | | | | | | Hobart C. Kalkstein | | | | 14,031 | | | | | 249,315 | | | | | 7,904 | | | | | 341,295 | | | | | | | Jeff Zhu | | | | — | | | | | — | | | | | 8,431 | | | | | 364,051 | |

Pension Benefits Cabot’s salaried employees in the U.S. who were employees prior to January 1, 2014 (including each of our U.S.-based named executive officers) participateparticipated in Cabot’s Cash Balance Plan and, in certain cases, our Supplemental Cash Balance Plan. The Cash Balance Plan and the Supplemental Cash Balance Plan were each frozen on December 31, 2013, and with CABOT CORPORATION 57

Executive Compensation (continued) no further benefits will accrueaccruing under those plans. The benefits provided under these plans are described below.

Cash Balance Plan

The Cash Balance Plan is a funded,tax-qualified defined benefit plan. Prior to January 1, 2014, participants in the Cash Balance Plan accrued benefits from defined notional contributions(“pay-based credits”) in an amount equal to 3% of eligible compensation during their first five years of service, 3.5% during their next five years of service and 4% for years after ten years of service. Additional credits of 2% of earnings were provided on eligible compensation in excess of the Social Security wage base. Eligible compensation included base salary and short-term incentive bonus payments. Participants also received a guaranteed rate of return (“interest-based credits”) on their account balances.

that date. The Cash Balance Plan was terminated effective July 31,in fiscal 2019 and following the regulatory process, including application for a Determination Letter from the IRS, the plan is expected to be fully settled duringin fiscal 2020 through the payment of lump sums and purchase of annuities. While the plan is frozen, interest-based credits are earned on account balances during a calendar year at theone-year U.S. Treasury bill rate determined as of November of the previous year until the participant begins receiving benefit payments or until July 31, 2019, if earlier. For calendar year 2019, through July 31, 2019, the interest credit rate was 2.70%. Effective July 31, 2019, as a result of the plan termination, the annual interest credit rate was fixed to 0.86%, which is the average of annual interest credit rates for the five-year period ending on July 31, 2019. At retirement at any age or other termination of employment, a participant eligible for benefits may receive his or her vested account balance in a lump sum payment or in a monthly pension having an equivalent actuarial value.

Participants are 100% vested in their accounts after three years of employment with Cabot. As of September 30, 2019, all of our named executive officers were fully vested in their account balances under the Cash Balance Plan.

Supplemental Cash Balance Plan2020.

The Supplemental Cash Balance Plan is an unfunded,non-qualified defined benefit plan created to provide benefits in circumstances where maximum limits established under the Internal Revenue Code preventprevented participants from receiving some of the benefits that would otherwise behave been provided under thetax-qualified Cash Balance Plan. The Internal Revenue Code limitslimited the amount of compensation that cancould be taken into accountconsidered annually to determine benefits under thetax-qualified Cash Balance Plan. The Supplemental Cash Balance Plan was intended to provide eligible employees the same benefits they would have earned under the Cash Balance Plan if this compensation limit did not apply. While the plan is frozen, interest-based credits are earned on account balances during a calendar year at the one-year U.S. Treasury bill rate determined as of November of the previous year until the participant begins receiving benefit payments. At retirement at any age or other termination of employment, a participant eligible for benefits may receive his or her vested account balance in a lump sum payment or in annual installment payments. Participants were 100% vested in their accounts after three years of employment with Cabot. The material terms and conditionsAs of September 30, 2021, all of our U.S.-based named executive officers who are participants in the Supplemental Cash Balance Plan are the same as those of the Cash Balance Plan except that benefits otherwise payable from the Supplemental Cash Balance Plan will be forfeited if a participant’s employment is terminated for cause.

CABOT CORPORATION 51

Executive Compensation(continued)

were fully vested in their account balances. Pension Benefits Table TheFor each of our U.S.-based named executive officers, the following table shows the actuarial present value of each named executive officer’s accumulated benefits under the pension plan(s) in which he or she participatedSupplemental Cash Balance Plan as of September 30, 2019,2021, the last day of our most recent fiscal year, and the pension plan measurement date used for financial statement reporting purposes for our fiscal 20192021 financial statements. None ofMs. Kalita does not have a balance under the named executive officers received a payment under these plans during fiscal 2019.Supplemental Cash Balance Plan.

| | | | | | | | | | | | | Name

| | Plan Name

| | Number of Years

of Credited Service

(#)(1)

| | Present Value of

Accumulated Benefit

($)(2)(3)

| Sean D. Keohane

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 11

11

| | | | 103,292

138,850

| | Erica McLaughlin

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 11

11

| | | | 67,938

6,376

| | Karen A. Kalita

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 5

5

| | | | 29,147

—

| | Hobart C. Kalkstein

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 9

9

| | | | 74,746

26,474

| | Brian A. Berube

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 19

19

| | | | 199,989

214,082

| | John R. Doubman

| | Cash Balance Plan

Supplemental Cash Balance Plan

| | 7

7

| | | | 61,040

22,762

| |

| | | | | | | | | | | | | Name | | Plan Name | | Number of Years

of Credited Service

(#)(1) | | Present Value of Accumulated Benefit ($)(2) | | | | | Sean D. Keohane | | Supplemental Cash Balance Plan | | | | 11 | | | | | 130,734 | | | | | | Erica McLaughlin | | Supplemental Cash Balance Plan | | | | 11 | | | | | 5,634 | | | | | | Karen A. Kalita | | Supplemental Cash Balance Plan | | | | — | | | | | — | | | | | | Hobart C. Kalkstein | | Supplemental Cash Balance Plan | | | | 9 | | | | | 24,447 | |

| 1. | Credited service for the Cash Balance Plan and Supplemental Cash Balance Plan represents years of service with Cabot as of December 31, 2013, the date the plans wereplan was frozen, rounded to the nearest whole year. |

| 2. | The following assumptions were used in the calculations: |

| | | | | | | | | | | | | | Cash Balance Plan | | Supplemental Cash Balance Plan | Measurement Date | | | | 9/30/2019 | | | | | 9/30/2019 | | Discount Rate (for present value calculation) | | | | 2.63 | % | | | | 2.81 | % | Form of benefit | | | | Lump sum | | | | | Lump sum | | Retirement Date | | | | Age 65 | | | | | Age 65 | |

3. | For the Cash Balance Plan the account balances as of September 30, 2019 for Mr. Keohane, Ms. McLaughlin, Ms. Kalita, Mr. Kalkstein, Mr. Berube, and Mr. Doubman were $128,653, $99,330, $44,371, $97,778, $227,747, and $81,951, respectively. As of July 31, 2019 the interest crediting rate for the plan was fixed at 0.86%. For the Supplemental Cash Balance Plan the account balances as of September 30, 2019 for Mr. Keohane, Ms. McLaughlin, Mr. Kalkstein, Mr. Berube, and Mr. Doubman were $130,895, $5,757, $24,630, $206,735, and $21,030 respectively. Ms. Kalita does not have a benefit under the Supplemental Cash Balance Plan. As of September 30, 2019 the assumed interest crediting rate for the plan was 3.25%. The actual interest crediting rate will be determined annuallycalculations for the Supplemental Cash Balance Plan. The differences between the actual account balances and the present values reported above are a result of how the assumed interest crediting rates for each plan relates to the discount rate and the methodology used to determine present values under US GAAP accounting and SEC rules.Plan:

|

52 CABOT CORPORATION

| | | | | | | | Supplemental Cash Balance Plan | 2020 PROXY STATEMENT Measurement Date

|

Executive Compensation(continued)

| | | 9/30/2021 | | |